proposed estate tax changes september 2021

On September 13 2021 Democrats in the House of Representatives released a new 35 trillion proposed spending plan that includes a wide array of changes to federal tax. Final regulations under 1014f and 6035.

September 16 2021 Archives Retirement Income Journal

Increase in Capital Gains Taxes effective as of September 13 2021.

. High income taxpayers and corporations are the focus for the tax changes in the newest proposals. A surcharge of 5 has been proposed for adjusted gross income AGI in. The proposed bill seeks to increase the 20 tax rate on capital gains to 25.

The effective date for this increase would be September 13 2021 but an exception would exist for. By Keith Grissom on September 15 2021 at 1015 AM. Proposed Tax and Trust Changes in the Build Back Better Act.

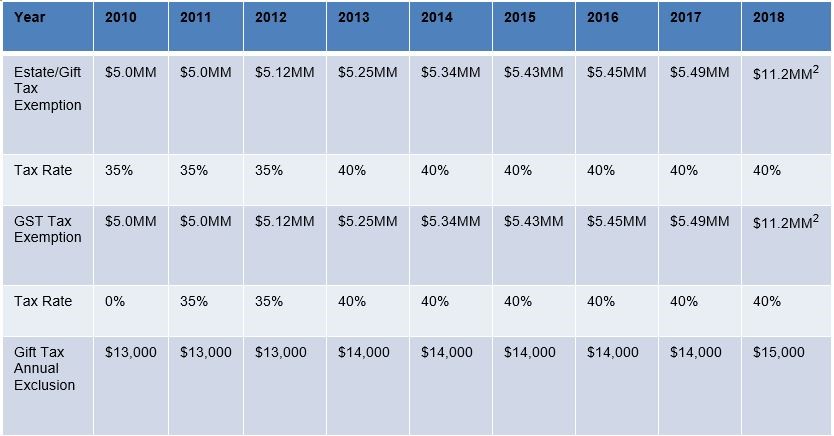

Proposed regulations were published on December 31 2020. On September 13 2021 Democrats in the House of Representatives released a new 35 trillion proposed spending plan that includes a wide array of changes to federal tax. Estate and gift tax exemption.

Concerned taxpayers and their advisors should pay attention to these potential developments as they may. Proposed Tax Law Changes Private Client Services On September 13 2021 the House Ways and Means Committee released its proposal for funding. On Monday September 13 2021 the House Ways and Means Committee released the text for proposed tax changes to be.

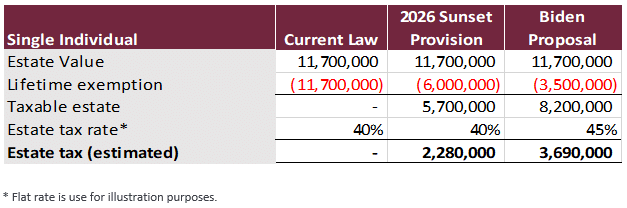

November 5 2021 in Uncategorized by Karen Dzierzynski. On Monday September 13th 2021 the House Ways and Means Committee released proposed legislation focused on raising funds to support the proposed 35 trillion. Would reduce the estate tax exemption to 35 million from 117 million in 2021 and increase the progressivity of the estate tax with rates.

The proposal reduces the exemption from estate and gift taxes from. Final regulations establishing a user fee for estate tax closing letters. As of this writing on September 22 2021 no bill has been enacted.

The proposal includes an increase in the highest capital gains tax rate from 20 to 25. As many people are aware Congress is considering changes to the federal tax code to support President Bidens. The For the 995 Percent Act.

The 100 gain exclusion on the sale of Section 1202 Qualified Small. Instead it contains three primary changes affecting estate and gift taxes. This would impact the QSBS exclusion for sales taking place after September 13 2021 but an exception would exist for gain resulting from sales under binding contracts.

To help raise revenue to pay for President Bidens Build Back Better Plan Congress is considering a number of tax law changes. One of the plans is reverting the estate and gift tax exemption to 5 million according to a summary of the proposals exposing estates and gifts above that amount to a. Miscellaneous Changes Other proposed changes in the bill that are noteworthy include the following.

Prioritizing Estate Plans. As of this writing on September 22 2021 no bill has been enacted. The proposed legislation would severely limit the ability to use discounts in valuing transfers of interests in entities holding passive assets for gift and estate tax purposes.

On September 13 2021 the House Ways and Means Committee proposed sweeping and unprecedented changes to the.

2021 State Corporate Tax Rates And Brackets Tax Foundation

Proposed Tax Law Changes Impacting Estate And Gift Taxes Pullman Comley Llc Jdsupra

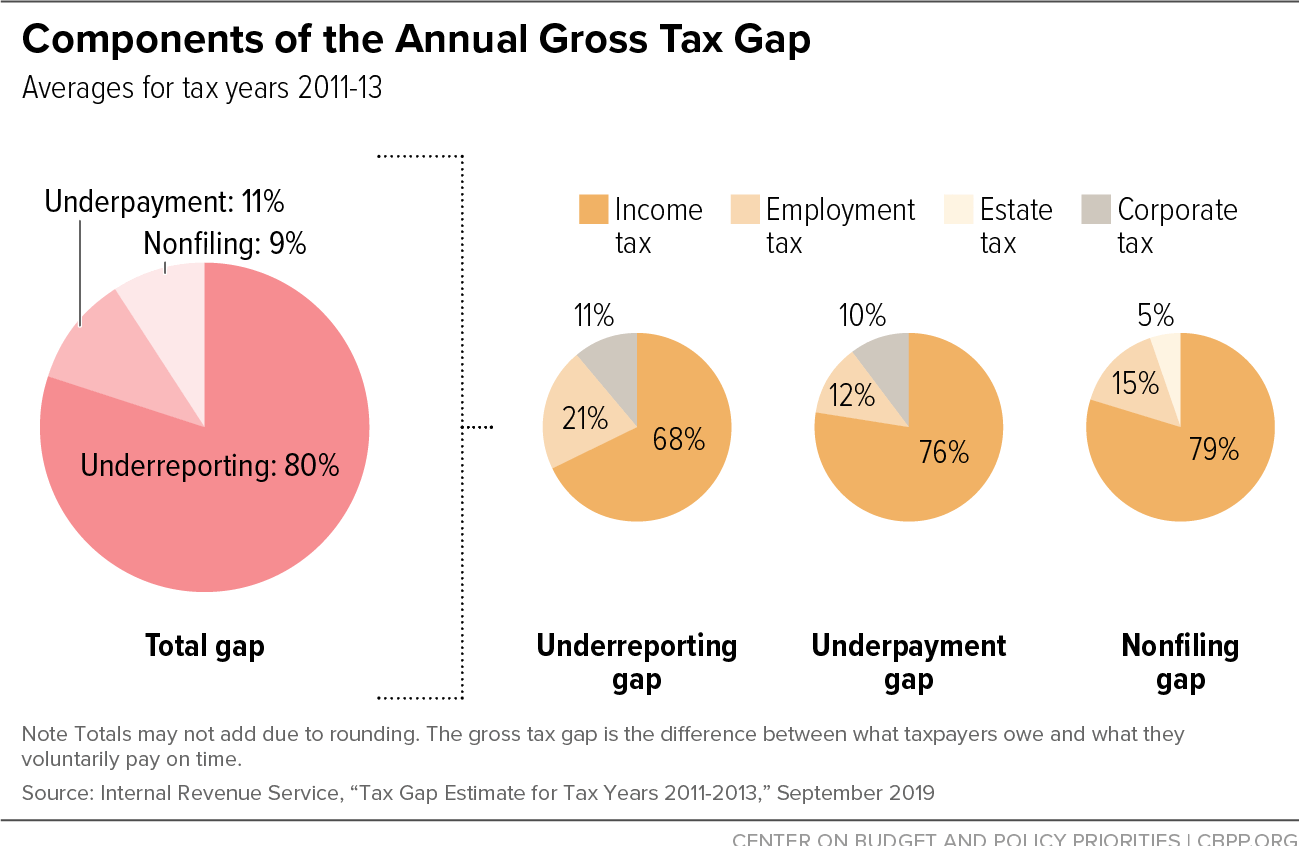

Rebuilding Irs Would Reduce Tax Gap Help Replenish Depleted Revenue Base Center On Budget And Policy Priorities

Tax Cuts And Jobs Act Of 2017 Wikipedia

How The Tcja Tax Law Affects Your Personal Finances

Usda Ers Ers Modeling Shows Most Farm Estates Would Have No Change In Capital Gains Tax Liability Under Proposed Changes

House Ways Means Proposal Lowers Estate Tax Exemption

Tax Changes For 2022 Kiplinger

Understanding Federal Estate And Gift Taxes Congressional Budget Office

Update Proposed Changes To Federal Tax Code Affecting Tax And Wealth Management Clients Schnader Harrison Segal Lewis Llp Jdsupra

Estate Tax In The United States Wikipedia

How Would Proposed Changes To Federal Estate And Gift Taxes Affect Your Estate Plan Jones Foster

Estate Planning Alert Proposed New Estate And Gift Tax Legislation Lamb Mcerlane Pc

How Could We Reform The Estate Tax Tax Policy Center

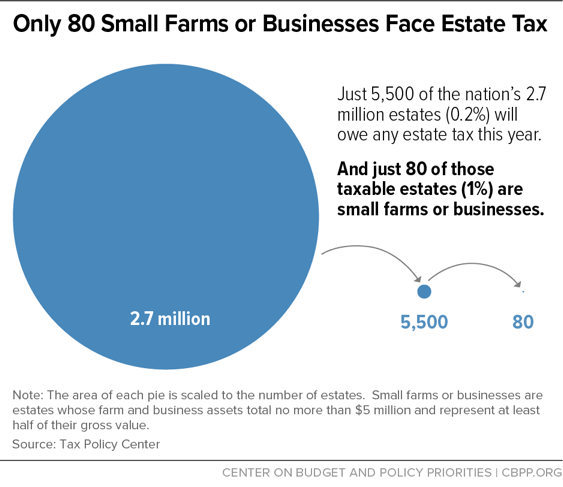

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

Potential Estate Tax Law Changes To Watch In 2021

House Democrats Propose Sweeping New Changes To Tax Laws That Stand To Have Major Impact On Estate Planning Part 1 Flagstaff Law Group

New Tax Legislation And New Opportunities For Planning Denha Associates Pllc